The CHASSIS INDUSTRY

NEEDS AN UPDATE.

BADLY.

We’ve all read the articles over the past 11 years about the latest marine chassis crisis. We’ve all read about how far behind the United States is compared to the rest of the world with regards to chassis. We’ve all read about how truckers are dissatisfied and how there’s the constant threat of another chassis shortage bottlenecking the supply chain. The articles are great at identifying the problems and how they got started, but few offer hope for the future.

- Chassis leasing companies

- Gray pools

- Co-ops (NACPC, etc.)

- Trucker owned chassis

- Ocean terminals

- Specialty pools

- Ocean carrier-controlled chassis

Current Situation: Chassis Leasing Companies Stay the Course

The current leasing companies, or IEPs (Intermodal Equipment Providers), supply chassis to various sectors of the market, including pools. Once the ocean carriers divested their chassis, the IEPs became the de-facto source for chassis and everyone looked to them to provide solutions to manage those chassis efficiently. Unfortunately, it’s not apparent that they’ve lived up to that task. To be fair to the IEP’s, they were dealt a bad hand. Instead of their traditional 50 customers, they found themselves with thousands of customers to handle. It appears, however, that the IEPs are content to do little in the way of innovative problem-solving. They are seemingly stuck in the middle of two groups:- Truckers demanding more choice

- Ocean carriers keeping a firm chokehold on the process with convoluted box rules

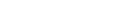

1st Scenario: Drayage Carriers’ “Truckers” Control the Chassis

For the most part, the rest of the world operates on a ‘trucker model.’ This is where the drayage carrier provides its own chassis when picking up a container at the port. There’s a lot of advocates for this model here in the US, but after 11 years, we’re not much closer to it than when we started. The reality of getting there poses a number of hurdles, including the trucker’s ability to invest in chassis, that thus far have proven to be insurmountable.

Given the amount of time that’s passed and the lack of progress, we feel it will be some time before a trucker model could rise to the top here in the US. But…

If it happened today, these are the advantages/disadvantage for each party:

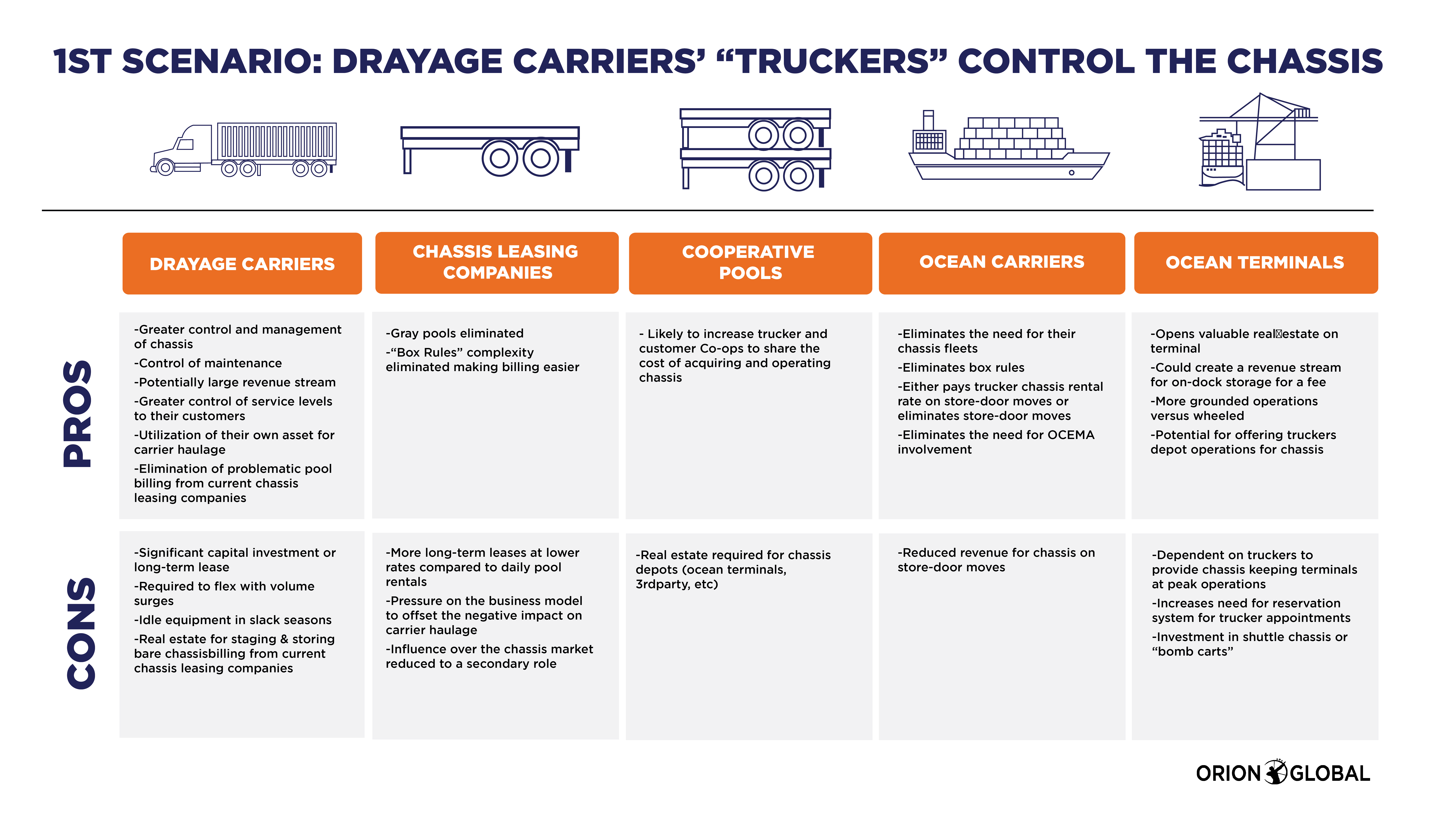

2nd Scenario: Cooperative Pools Become the Standard

Also, with the geographic distance, some ocean containers are being moved, we don’t see a single trucker model being the most efficient. That’s the reason that NACPC was created a few years ago. The NACPC is a cooperative pool allowing trucking companies who own their chassis to place them in a pool for their collective use. Is this a possibility on a national level?

If so, what are the impacts on the other players if this becomes the standard?

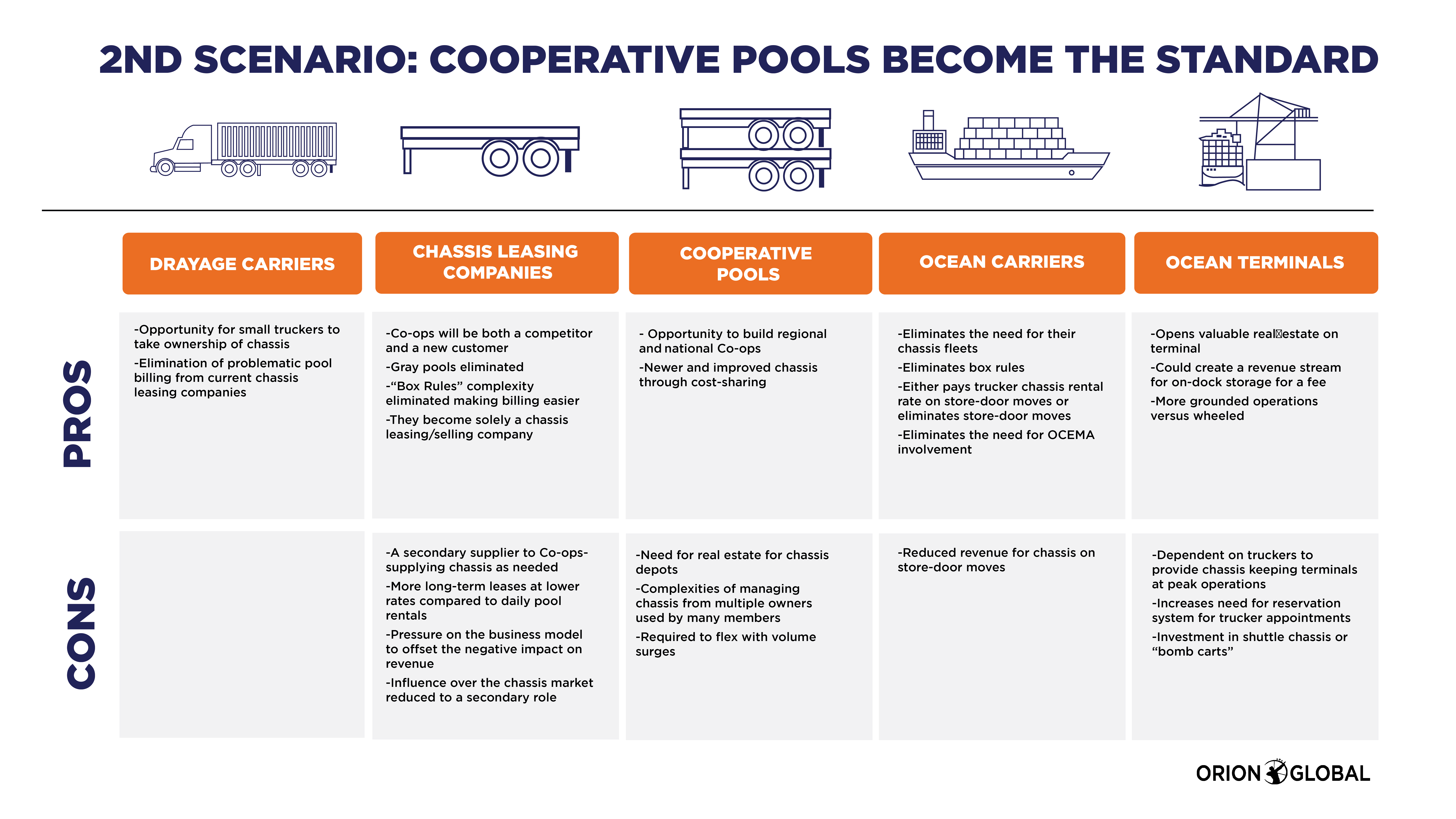

3rd Scenario: Ocean Carriers Get Back in the Business

The question that has to be asked here is, “Do we really want the ocean carriers to take the chassis over?” It’s not as simple as it was 11 years ago, and it wasn’t simple then.

There was a time when an ocean carrier called at one terminal in a port complex and that terminal was typically operated by a subsidiary of that carrier. While that’s still the case in some locations, it’s not the case in most. Because of Vessel Sharing Agreements and other reasons, carriers are calling at multiple terminals. If the ocean carriers assumed responsibility for providing the chassis, they would be managing their fleets across all terminals. This means that each terminal is going to have multiple carriers’ chassis fleets on their terminal.

Assuming the unlikely scenario of ocean carriers providing the chassis were to happen, how would that look?

Summary:

So, what the heck does all this mean? It means there isn’t a single solution to this convoluted mess that we know as chassis provisioning. What we do know is this:

- The current model is broken

- Trucker choice is popular, but years from reality

- CO-OPs can’t be the only answer

- Ocean carriers have only made getting back into the game more complicated for themselves and everyone else

As is usually the case, the solution lies somewhere in the middle, with all parties thinking outside the box. Participating in necessary change for the industry is long overdue. The irony of an industry that is built on moving things from one place to another literally staying in one spot for a decade on this issue is mind-boggling.

It comes down to this: Will we actually experience a sea change, or will we keep putting Band-Aids on this enduring wound? Will the parties put their minds together, compromise, and really fix it? Will one of them finally put forth a new model that everyone can coalesce around? Or will we continue to watch an industry create committees to solve its problems, barely scratch the surface and disband, only to rinse and repeat the next year? Who is going to stand up and do something worthwhile? Who is going to do something bold? Who has the brains and the brawn to see it through?

If you’re holding your breath, you shouldn’t. It’s going to be awhile.

Authors: Bill Knight and Kevin Higgins