Chassis Scenario 1:

Drayage Carriers Control the Chassis

Container shipments can be split into two models: carrier haulage and merchant haulage. These designations are the determining factors in who gets the chassis revenue and whether the trucker has a choice in what brand of chassis to use.

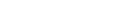

The so-called “Box Rules” that are used in carrier haulage have created a nightmare. The drayage carrier is providing the driver and tractor but may not have any say in the chassis to be used or the fee to be charged for its use. However, if there is a maintenance problem with the chassis, or if there is not a required chassis close by, the drayage carrier pays the price in the form of traffic citations for unsafe equipment, down time, and out-of-route miles.

To make matters worse, it’s not uncommon to find 10-15-year-old chassis still in service. And the billing processes for these “box rules” is incredibly complicated. Add to that the inefficiency of having to consider all this for every move day in and day out, and you see why dray carriers are unhappy with the current state of the industry.

If the Drayage Carriers Took Control...

So back to the dray carriers taking control. In this model, the dray carrier is responsible for providing the chassis and billing the ocean carrier or merchant for its use. Sounds simple enough, but like in all things, there are pros and cons.

Pros

From an operational perspective, this is a huge benefit for the drayage carrier. They would own the chassis and would not have to depend on availability from anyone other than their fleet. By controlling the fleet, they also control the maintenance, so there is an operational incentive for keeping the chassis maintenance up to par. Having complete control over the chassis would also allow the dray carrier greater control of service levels to their customers, as they would no longer be dependent on outside equipment sources.

Another problem solved by dray carriers taking ownership of the chassis would be the elimination of pool billing issues. Many dray carriers currently dedicate staff to auditing the invoices coming from equipment providers for pool usage. Some pool billings can come in as late as 120 days later, making accurate customer invoicing difficult for dray carriers. In addition to untimely billings, dray carrier’s must be ready to dispute billings due to unreliable terminal data used by chassis providers. Here’s a sample of the billing flow for your viewing pleasure. To be rid of this issue would be a huge victory for dray carriers.

Cons

The biggest challenge we see for the drayage carriers is the capital required to buy their own chassis. Chassis prices average around 10k, so for a dray carrier needing 300 chassis for their fleet, they’d be out a quick 3 million dollars. Take into consideration it’s not just a 1 for 1 move. Today, the average dwell time for a chassis on the street is 8 days. For every day’s moves you need 8 more containers that are going to be sitting somewhere. Larger dray carriers can swing this, but the smaller ones will have a challenge. Considering that drayage carriers are already operating on thin margins and increased costs of trucks, this might be a heavy lift for them.

To take on the chassis ownership 100%, the drayage carriers would also be faced with managing their idle equipment in slack season and flexing their pools during peak season. This is when creating/using cooperative pools or chassis leasing companies would be beneficial.

How Would Chassis Leasing Companies Be Affected?

Things would get interesting for chassis leasing companies with a major shift in their traditional business model but the need for the chassis they own would not change. Instead of contributing chassis to private pools or negotiating terms with ocean carriers, they would be contracting directly with drayage carriers or cooperative pools. It’s not hard to imagine that with the leverage drayage carriers would have, there would be tremendous pressure on lease rates and increased maintenance cost to chassis leasing companies.

It wouldn’t be all bad news. With the elimination of box rules, billings and collections would be vastly simpler and reduce operating cost. Further, since there wouldn’t be a need for grey pools, the pressure to participate in these arrangements would be eliminated.

How Would Cooperative Pools Be Affected?

As mentioned before, even with truckers calling the shots, the capital needed to acquire chassis would be a challenge for many dray carriers. The most likely place to turn would be to create cooperative pools organized and managed by participating dray carriers.

A challenge for cooperative pools would be acquiring the real estate close to ocean ports to serve as a depot. The real estate is there, but it’s currently owned by chassis leasing companies, terminals, and/or ports. Therefore, negotiating long term leases would be vital to a cooperative pool’s success.

How Would Ocean Carriers Be Affected?

This would finally get the ocean carriers completely out of the chassis business. They helped create what we know as “box rules” and this would effectively eliminate those as well. For their carrier haulage moves, the ocean carrier would then pay their nominated drayage carrier a chassis usage fee. This makes it much simpler.

In fact, if the ocean carriers wanted to do what they’ve been talking about for years, they could also stop providing store door service and go 100% to merchant haulage moves from the ports or rail yards.

What we don’t know and aren’t privy to is what kind of financial arrangements the ocean carriers have with the chassis leasing companies on carrier haulage moves. Will this cut into a revenue stream for them? Quite possibly.

How Would Ocean Terminals Be Affected?

The move towards trucker owned chassis can have both positive and negative effects on the MTOs. Some terminals are still a wheeled operation so it means they would have to convert to a grounded operation. They would also need to invest in either their own chassis, or “bomb carts” for yard movements.

We see it also as a possibility to reclaim real estate currently used for chassis storage and/or monetize that real estate. For example, charging storage fees to truckers who want to stage chassis at the terminal. This means the possibility exists to create a depot operation for the drayage companies as well.

On the downside, they will be 100% dependent on the drayage companies to ensure they have enough chassis for peak season to keep their terminals operating at optimal performance.

Summary

Based on numbers that we have seen, approximately 30-40% of all moves at the ports have converted to trucker owned chassis. In other countries, they are at 100%. But they also don’t have the large geographic scope that we do in the US. For the truckers to get to 100% of the chassis moves, it’s going to take a substantial capital investment. So, for that reason, it’s not going to be an overnight solution. Their margins are incredibly thin as it is so it will take them time to get there, if they are ever able to.

Stay tuned for more narrative around scenario 2 in the very near future.